Royal Vaassen

Founded in 1867 as a tin foundry, since 1924 a leading producer of aluminium flexible packaging materials. With now the Predicate Royal, Royal Vaassen Flexible Packaging (shortened to Royal Vaassen) focuses on three main markets: food, industry and tobacco. This has created a stable basis for further development.

Core values. Within all these markets, three concepts are central:

-

- Sustainability

- Innovation

- Service

Sustainability of both the product and the process is central to everything Royal Vaassen develops. Aluminium can be recycled endlessly, and paper (our second largest raw material) is also easy to recycle. They also work with recycled PET. Energy is based on hydropower and we offset CO2 emissions from gas consumption. Then there are all kinds of measures for waste reduction, emissions reduction, etc.

Innovation is the essence of Royal Vaassen's competitiveness. This is about both product and process. To operate sustainably, continuous innovation is essential.

The customer is central at Royal Vaassen. Not only in the product solutions chosen, but also in the service offered. The service varies from excellent technical service (remotely and on-site) to guide new introductions, do qualifications and document and guarantee food safety. In addition, the service consists of fast logistical response and high delivery reliability.

Issue

Royal Vaassen requested support in providing insight into price and efficiency differences from factory accounting within Infor LN. Some of the general ledger accounts in LucaNet (reporting tool) contain entries from automatic runs (integration mutations) from the financial package (Infor LN), particularly in the areas of price differences, shifts and stock movements. Due to changes in Royal Vaassen's workforce over the past few years, knowledge of these integration mutations has partly disappeared. This makes explanations regarding differences in these items more difficult.

Our approach

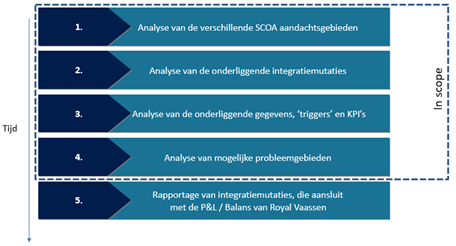

Our proposed approach has four phases, see below in Figure 1.

Figure 1. Our proposed phased approach.

1. Mobilisation, familiarisation and initial analysis of SCOA focus areas

This phase includes a kick-off meeting with the client, including discussion and fine-tuning of expectations and approach. Then, together with the client, an initial rough analysis is made of the SCOA focus areas and relevant accounting items. This results in an initial demarcation of the area to be investigated and fine-tuning of expectations.

2. Analysis of underlying integration movements

The next step is the analysis phase. In this, the following integration mutations in Infor LN are examined in more detail and the possible connection between integration mutations. Can the purpose and intent of the integration mutation be found out?

3. Analysis of underlying data, triggers and KPIs

In this phase, the underlying data, triggers and KPIs, which underlie the integration changes, are further analysed. This analysis consists of:

- an analysis of the relevant journal entries

- an analysis of the underlying data and 'triggers'

- an analysis of the relevant KPIs

4. Reporting (analysis of problem areas)

In this step, an analysis of possible "problem areas" (partly based on interviews) takes place. This step resulted in an overview (in Excel and PPT) of the relevant SCOA areas, accounting items and data, as well as possible risk areas.

An elaboration of the advice regarding the findings from these focus areas in the accounts/administration also took place. After reconciliation of the draft advice with the client, the final report then took place.

Result

Using the chosen methodology, the integration mutations were described in a similar and unambiguous way in both Excel and PPT. This has provided insight into the operation of the integration mutations in the SCOA areas of price and efficiency differences, as well as their coherence. By making this coherence understandable by means of an example, it became clear how the set-up of the VVP integration mutations, among others, worked. As separate mutations, it was difficult to understand. Particularly by providing insight into this relationship, we managed to fulfil this assignment.

Furthermore, additional deliverables were delivered regarding a SCOA analysis and a related Chemistry Chart. With the main additional advice being that the numbering of the SCOA within Royal Vaassen could be organised more logically.

The integration mutations examined covered only a small part of the SCOA focus areas. We advised Royal Vaassen to examine the other SCOA areas in more detail in the same format so that there is one reference document covering all integration mutations present.

And finally, we advised Royal Vaassen to set up a report that would provide a quick and clear insight into the price and efficiency differences per order. In this way, Royal Vaassen would be able to steer more effectively and gain a better understanding of why price and efficiency differences can occur on orders.