Starting point

The starting point for setting up a portfolio is often a list of initiatives collected from the organisation, or in the case of a 'rolling' portfolio, there is a 'counter' where initiatives can be registered, which then collectively form the portfolio. Certain initiatives are defined from higher up and others are registered at the designated counter from well-intentioned considerations. On content, it goes from ripe to green. Balance is generally still a long way off. The problem is that if there is an imbalance in content, problems may arise in implementation, in being able to cope with the change (capacity for change), but also in achieving the objectives. So a broad pallet of possible problems/challenges. In addition, in-balance in implementation and change capacity can also create the necessary challenges, but we will leave that aside for now. So an organisation still has to find balance when setting up a realistic portfolio of change initiatives for the coming period and organisations do this with a number of so-called checks and balances.

Different perspectives to balance the portfolio

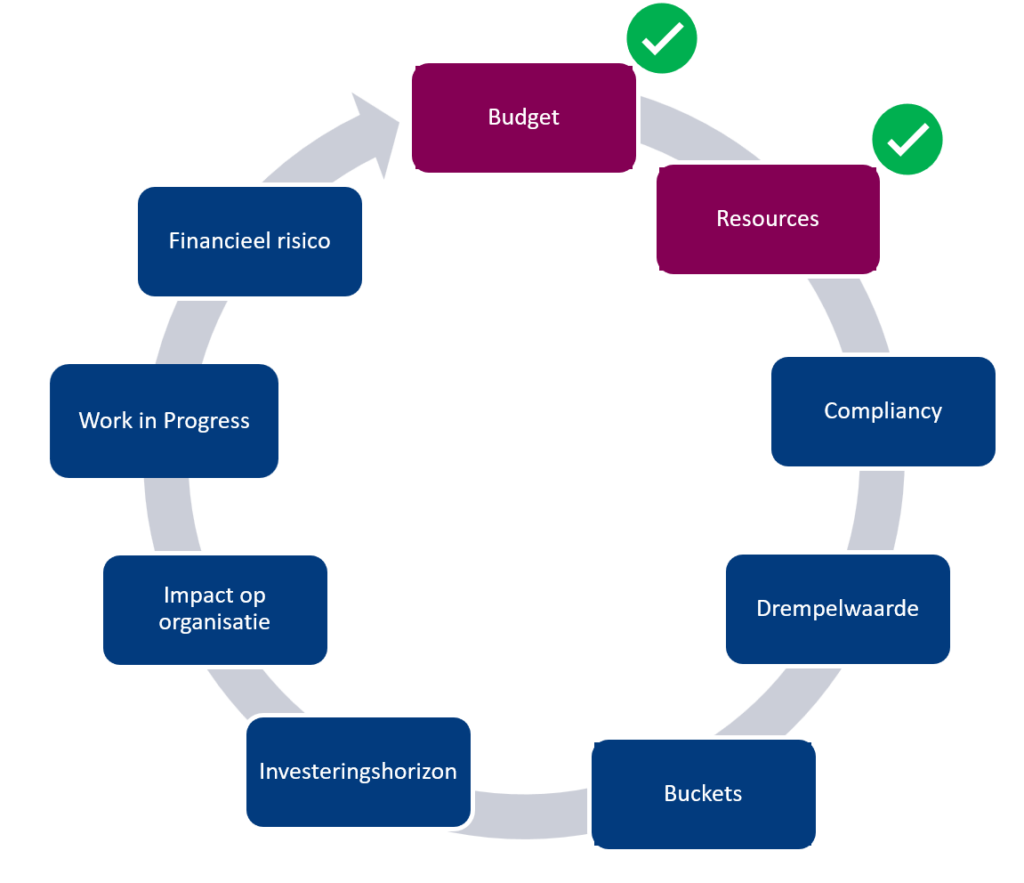

Organisations face a limited budget and a certain maximum of available human resources. This provides an important initial framework for the objectives to be achieved. Using selection criteria, the design of a portfolio then takes further shape.

Many organisations experience in practice when filling the portfolio that it is not balanced. Too many of the same type of initiatives, too many financial risks locked in and, for example, too much focus on the now (the short term). But there must also be balance within the planning and a critical look at whether planning-technical too many high-impact initiatives are going live at the same time (although phased going live partly solves this), as this makes a big call on an organisation's change capacity.

So before a portfolio becomes final, a portfolio organisation should first take a close look at how they can create balance. Several checks and balances are available for this purpose.

Compliancy: Legislative and regulatory commitments. These types of initiatives often do not score that high, and when we look at the commitment of money and people, 'the cake is over' before an initiative related to laws and regulations comes into the picture. Often, not always, these are must-dos that an organisation cannot get away from. The right people within the organisation can do a good job of pinpointing which initiatives are real must-do's and which can still be pushed back a bit. However, a number of initiatives are seriously coming into focus. Other must-do's are the well-known projects prescribed by the holding company, for instance.

Threshold: Another way to balance and avoid proliferation of well-intentioned initiatives is to apply a threshold. Based on applied selection criteria, each initiative is given a derived score. If this score does not exceed the threshold, it stops there. This prevents the organisation from investing time and money in initiatives that do not make a strong contribution to organisational objectives. So it does not fall under portfolio steering and is therefore not part of the portfolio, but the organisation can choose to implement it as a departmental project outside the portfolio.

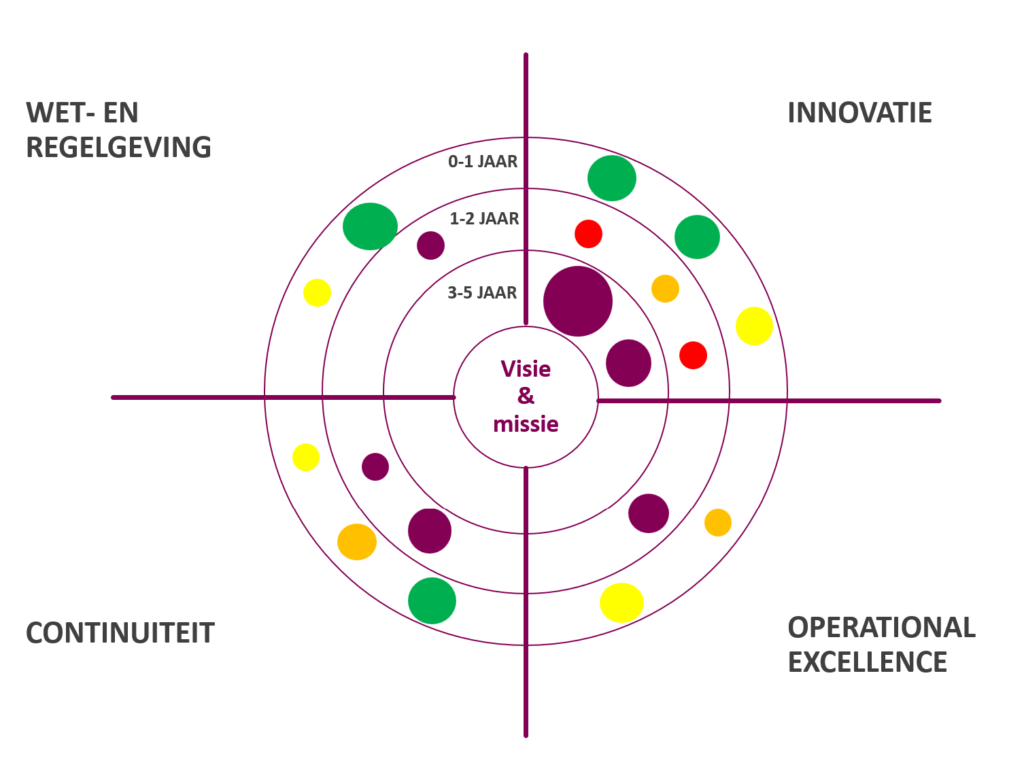

Buckets: Buckets or portfolio categories allow an organisation to balance across the portfolio in terms of project types. Figure 2 below shows a standard set-up, which can be adapted at your own discretion. Incidentally, this overview also immediately provides insight into the so-called Investment Horizons (0-1 year / 1-2 years / 3-5 years), the degree of impact of each initiative (depicted via the size of the bullet) and also Work in Progress depicted via a colour (purple = not yet started / red = definition phase to green for ready for implementation). That way, you have a kind of 4-in-1 overview in a pragmatic way, instead of via 4 different overviews.

What insights does applying buckets provide? An organisation can see whether the portfolio is not focusing too much on innovation which, in turn, can be at the expense of continuity. Or is the organisation putting enough emphasis on cost-saving initiatives given the organisation's current financial status? The ratios should be in line with what the organisation wants to grow towards, without it being (too much) at the expense of the organisation's continuity and laws and regulations that will apply to the organisation. In practice, there are plenty of examples of organisations that (almost) went under because the balance shifted too much towards innovation at the expense of the organisation's continuity and, as a result, they could no longer comply with laws and regulations (e.g. safety in the working environment). But also the other way around, that they continued to invest too much in continuity, without considering innovation and a future position in the market.

Investment horizons: Investment horizons provide insights into how the various initiatives within the portfolio are distributed over the short and medium term. Innovation-related projects in particular have a (medium-)long-term character. Based on Figure 2, it is immediately clear how the initiatives within the buckets are distributed over time. Is this the right balance or is it necessary to make shifts to achieve the desired balance?

Impact on organisation

Every change creates impact somewhere in the organisation. Too many change initiatives with a big impact on certain organisational units, make a big call on the organisation's change capacity. It is therefore important to dose / spread the impact where necessary, so that it is 'manageable' for the organisation / organisational unit. This can be achieved by planning a few initiatives in the portfolio with a limited impact on the organisation / organisational unit. That way, the organisation's capacity for change or absorption is not compromised. Only when an initiative is completed is there room for a new initiative to move up from the pipeline.

On the other hand, a mix of so-called Waterfall projects with a so-called 'Big Bang' delivery and phased deliveries according to an Agile working method can make an important contribution to spreading the impact more widely and thus keeping it within the limits of the organisation's change capacity. Without that mix, for example, this would not have been possible.

Work in Progress

The impact on the organisation can also be limited by a Work in Process limit. When the distribution over the buckets is balanced and also the distribution over the short-, medium- and long-term as well (figure 2), an organisation can also look further into a good mix of the different project phases of, in particular, initiatives with a high impact (change) on the organisation (Work in Progress). Specifically, how many change initiatives does an organisation want simultaneously in the realisation phase?

Financial risk: What financial risks is the organisation prepared to accept (so-called 'risk appetite')? Anyway, this varies by industry. A bank, for instance, will be able to accept fewer risks than, say, Tesla or Amazon, due to the nature of the industry.

On the one hand, an organisation will already exclude some initiatives at the front end due to the perceived risk because it exceeds a certain, predefined factor. On the other hand, an organisation also does not want to include too many initiatives within its portfolio that may fall within the accepted limits, but still (may) pose a financial risk to the organisation and the portfolio. Incidentally, these are often the initiatives with a catalyst function that the organisation needs to (quickly) connect to the set organisational objectives and increase its competitiveness. So here, too, there has to be the right balance in the accepted financial risk. The organisation's track record in successfully realising projects also plays a role here. If the organisation has a poor track record, it should fall back on projects with more proven solutions.

Another aspect is the execution risks of projects. Examples are: large amount of resources, dependence on other projects, dependence on new IT platforms (can be delayed by compliance), complexity of the project, dependence on critical resources (especially IT people), etc. Depending on the risk appetite, it can be decided not to do certain projects, but it can also be decided to do them but to add additional risk management measures (e.g. regular project audits, quality assurance, extra reporting, hiring heavier project managers, etc.)

Knobs to turn

So the first draft to arrive at a portfolio for the coming period will not necessarily be the final version. So there are a number of knobs a portfolio organisation can turn to bring the desired and necessary balance to its portfolio in order to arrive at a realistic portfolio. So balancing is also making choices, with 'winners' and 'losers'. It is good to observe the whole and its coherence and from there to see which adjustments are important, when and from which point of view. Unsurprisingly, it depends per organisation on when to turn which knobs.

Balancing is an essential activity to achieve a successful portfolio and therefore this component should be planned together with the stakeholders and, above all, practice in coordination with them and adjust if necessary.

Within the assignments Improven carries out, balancing is part of our approach and also an essential step to achieve a good and valuable portfolio.

Marco Langeveld is part of the Projects & Change department within Improven (https://www.improven.nl/nl/dienstverlening/projecten/project-portfoliomanagement/).